Fleet Size and Availability

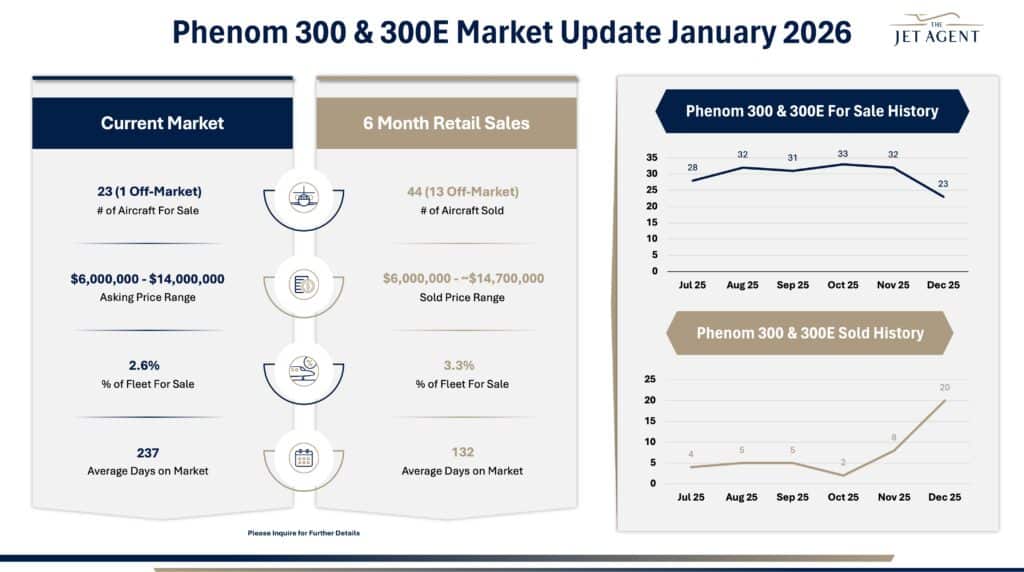

There are 23 Phenom 300 & 300E aircraft for sale, including 1 off-market listing, representing 2.6% of the active fleet. Inventory remains tight by historical standards, particularly given the size of the global fleet.

Market Listings

Asking prices currently range from $6,000,000 to $14,000,000, reflecting a broad spread driven by model, vintage, total time, avionics configuration, and engine program status. Active listings average 237 Days on Market, with longer marketing times concentrated among aircraft with price misalignment with the rest of the market, and international sellers. Well-positioned 300E aircraft with clean pedigree continue to attract the strongest buyer interest.

Sales Activity

Over the last six months, 44 Phenom 300 & 300E aircraft have sold, including 13 off-market transactions, at prices ranging from $6,000,000 to approximately $14,700,000. Sold aircraft averaged 132 Days on Market. December marked a notable increase in closings – 23 aircraft – underscoring the model’s strong year-end absorption.

Key Takeaways

- Inventory remains tight relative to sales volume, supporting firm pricing dynamics.

- The best-equipped 300E aircraft are achieving pricing at the upper end of the sold pricing range.

- Off-market transactions represent a meaningful share of total activity.

- Engine program status, avionics configuration, and pedigree remain key drivers of buyer interest.

Key Insight

The Phenom 300 & 300E start 2026 in a firm, buyer-selective market supported by tight inventory and strong underlying liquidity. Transaction activity remains robust, with year-end absorption underscoring continued buyer interest, particularly for well-equipped 300E aircraft. Pricing outcomes continue to separate clearly by specification, engine program status, and pedigree, with top-tier aircraft achieving the upper end of the sold pricing range. Overall, the Phenom 300 & 300E remain dependable and liquid segments of the preowned light jet market.