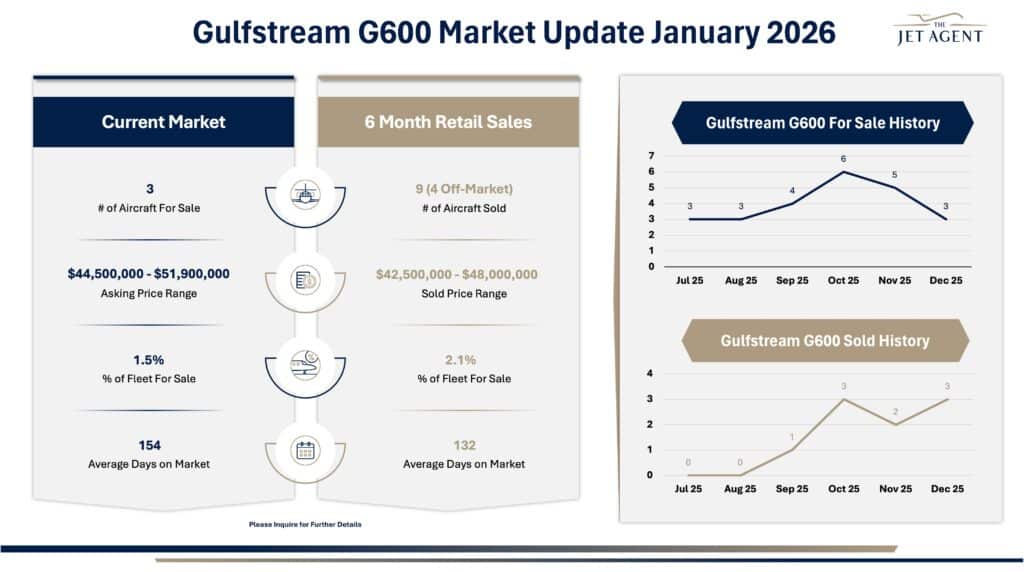

Fleet Size and Availability

There are currently three Gulfstream G600 aircraft available for sale worldwide, representing approximately 1.5% of the active fleet. Availability remains exceptionally constrained and has been consistently low over recent months, reflecting limited owner turnover rather than a lack of market interest. From a supply perspective, the G600 remains one of the tightest markets in the large-cabin segment, creating a structurally seller-favorable backdrop.

Market Listings

Asking prices range from $44,500,000 to $51,900,000. Pricing dispersion within the segment is driven primarily by delivery year, total time, cabin configuration, and maintenance status rather than capability differences, as the model’s performance envelope is broadly consistent across the fleet. Active listings are averaging 154 Days on Market, suggesting that while buyers are deliberate at this price tier, well-positioned aircraft remain competitive. Listings that linger tend to reflect pricing expectations that are modestly ahead of recent transaction benchmarks rather than any softening in demand.

Sales Activity

Over the past six months, nine Gulfstream G600 aircraft have sold, including four off-market transactions. Sale prices ranged from $42,500,000 to $48,000,000, with sold aircraft averaging 132 Days on Market. Sales volume relative to inventory remains notably strong, underscoring steady absorption in a market where availability, not buyer interest, is the primary limiting factor. The continued prevalence of off-market sales highlights the importance of access and discreet buyer–seller alignment in this segment.

Key Takeaways

• Inventory remains extremely limited and supportive of pricing stability.

• Sales activity is healthy relative to fleet size and available supply.

• Off-market transactions continue to represent a significant share of completed deals.

Key Insight

The Gulfstream G600 market is best characterized as supply-constrained rather than demand-limited. Sellers benefit from scarcity-driven pricing support, while buyers must rely on timing, relationships, and off-market access to secure well-positioned aircraft without overreaching on value.