Fleet Size and Availability

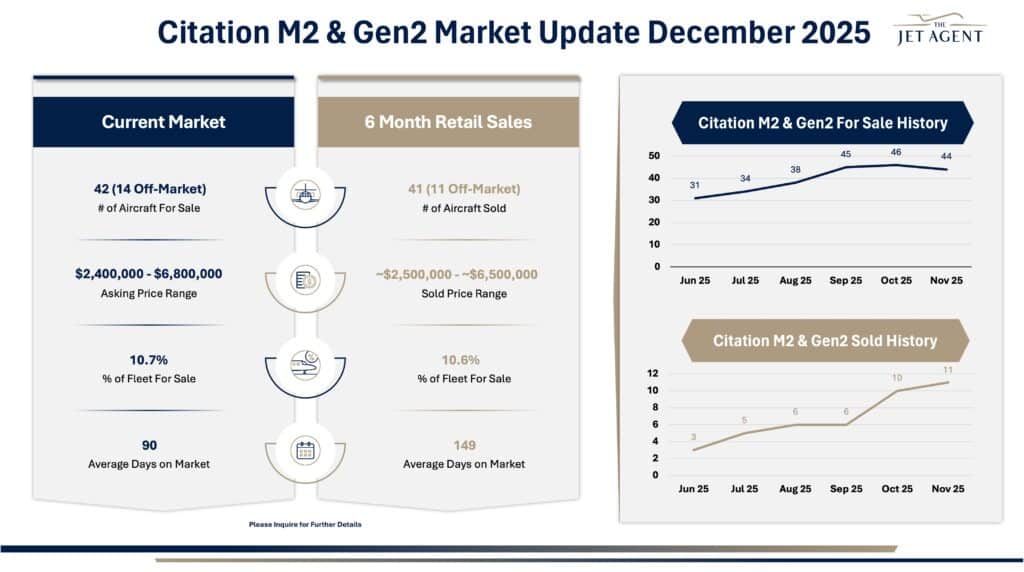

There are 42 Citation M2 & Gen2 for sale (including 14 off-market), representing 10.7% of the fleet. Inventory has contracted modestly from the prior month’s high of 46 listings, though availability remains elevated by historical standards. Buyers continue to enjoy broad selection, while sellers face a more competitive landscape.

Market Listings

Ask prices run $2,400,000–$6,800,000, with active listings averaging 90 Days on Market—slightly higher than prior months. Pricing dispersion continues to reflect clear stratification between early-build M2s and late-build or Gen2 aircraft, which maintain a measurable premium.

Sales Activity

41 sales (including 11 off-market) were recorded in the last six months at a range of ~$2,500,000–$6,500,000, averaging 149 Days on Market. Sales volume remains solid, with November recording the highest number of sales in the six-month period (11 sold). Absorption remains strong despite the elevated inventory.

Key Takeaways

• Inventory has pulled back slightly from its peak, creating a more balanced, but still competitive, environment.

• Average Days on Market has increased slightly for current listings reflecting increased buyer selectivity rather than demand erosion.

• The market maintains a clear bifurcation: Gen2 models and top-spec M2s retain pricing power.

• Off-market transactions account for a meaningful share of sales.

• Sellers with market-aligned ask pricing are achieving faster execution speeds.

Key Insight

The Citation M2/Gen2 remains the liquidity leader in entry light jets. While inventory remains ample, the market is adjusting constructively: disciplined pricing is rewarded with reliable execution, and well-positioned aircraft continue to transact efficiently.