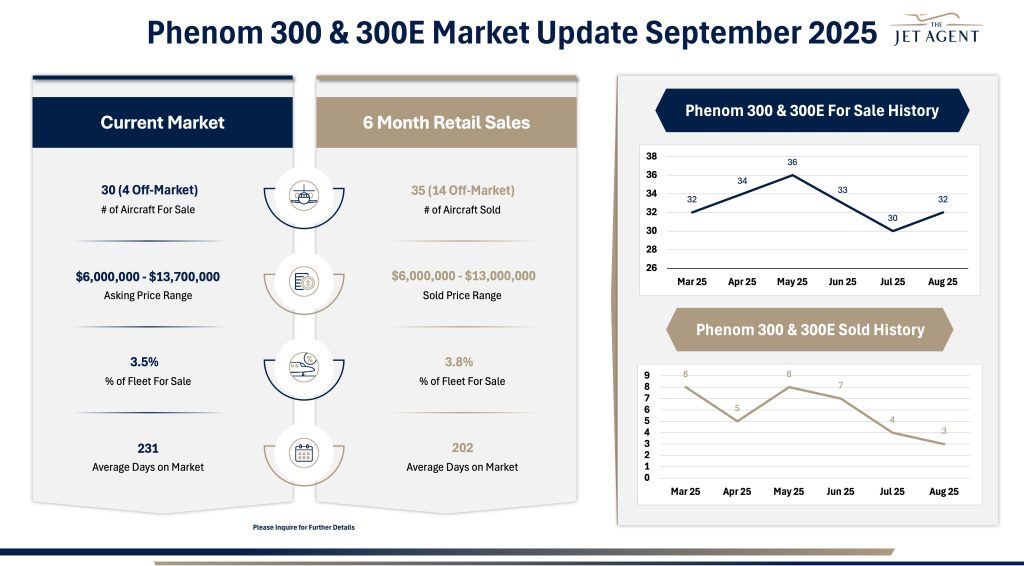

Fleet Size and Availability

There are 30 Phenom 300/300E aircraft for sale, including 4 off-market, equal to 3.5% of the fleet. Availability eased from July’s trough and remains below spring levels.

Market Listings

Asking prices range from $6,000,000 to $13,700,000, with listed aircraft averaging 231 days on market. Despite slight inventory growth, marketing times remain elevated for higher-ask units.

Sales Activity

In the past six months, 35 aircraft sold, 14 off-market, at prices between $6,000,000 and $13,000,000. Sold aircraft averaged 202 days on market, notably faster than current inventory.

Key Takeaways

-For-sale counts trended 32 → 34 → 36 → 33 → 30 → 32 (Mar–Aug), showing a mild late-summer rebuild after a July low.

-Monthly sales moderated from spring highs (approx. 9 in Mar, 8 in May) to lower summer levels, but volume remains the strongest among light jets.

-The sold-DOM advantage (202 vs. 231) underscores the benefit of market-aligned pricing and attractive spec packages.

-Off-market remains a critical channel, accounting for 40% of transactions over six months.

Key Insight

The Phenom 300/300E market continues to lead light-jet liquidity: even with a modest inventory uptick and seasonally softer closings, well-priced, pedigree-rich aircraft are clearing faster than listings overall—suggesting a healthy, transaction-driven market heading into fall.