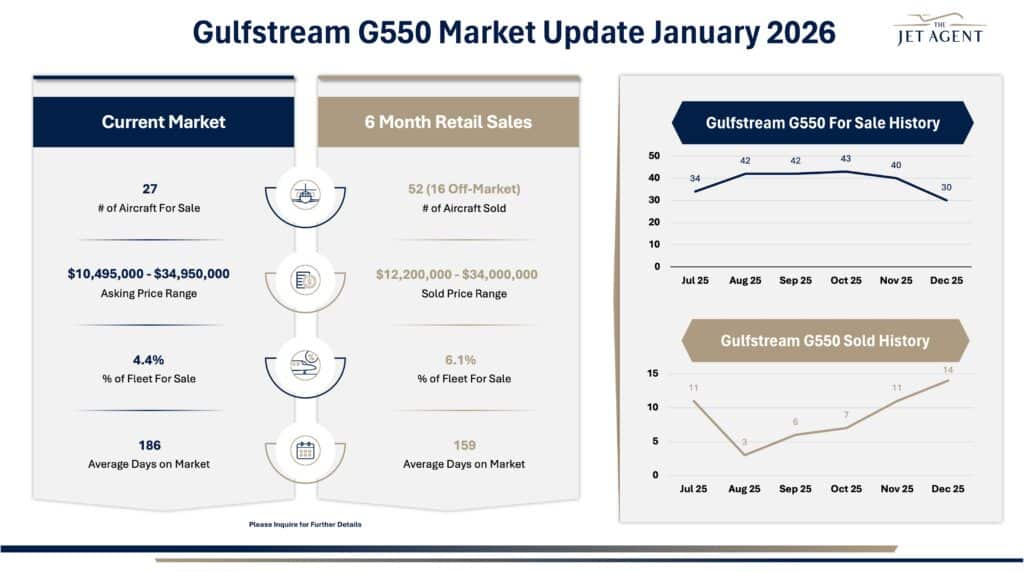

Fleet Size and Availability

There are currently 27 Gulfstream G550 aircraft available for sale worldwide, representing approximately 4.4% of the active fleet. Inventory remains well controlled and below levels typically associated with structural pricing pressure. After a modest rise in availability earlier in the year, listings have stabilized, indicating that most sellers entering the market are doing so deliberately rather than under distress. Relative to fleet size, current supply remains supportive of continued transaction activity.

Market Listings

Asking prices range from $10,495,000 to $34,950,000, reflecting a wide pricing spread driven by model year, engine program enrollment, avionics configuration, interior condition, and recent maintenance events. Aircraft positioned at the upper end of the pricing range are generally later-build examples with upgraded cabins and strong maintenance status, while lower-priced offerings often reflect upcoming inspections or deferred cosmetic investment. Active listings are averaging 186 Days on Market, underscoring that buyers remain selective but engaged when pricing aligns with condition and pedigree.

Sales Activity

Over the past six months, 52 Gulfstream G550 aircraft have sold, including 16 off-market transactions. Sale prices ranged from $12,200,000 to $34,000,000, with sold aircraft averaging 159 Days on Market. Notably, six-month sales volume materially exceeds current inventory, highlighting strong absorption and reinforcing the G550’s position as one of the most liquid legacy large-cabin platforms. Off-market activity continues to represent a significant portion of completed transactions, suggesting that visible inventory alone understates true market depth.

Key Takeaways

• Inventory remains disciplined and supportive of values.

• The G550 continues to exhibit strong liquidity relative to fleet size.

• Off-market transactions play a meaningful role in market clearing.

Key Insight

The Gulfstream G550 market remains resilient and highly functional, supported by broad global demand, proven mission capability, and a deep buyer pool. Well-positioned aircraft continue to transact efficiently, while pricing misalignment—rather than lack of demand—remains the primary driver of extended marketing timelines.