Fleet Size and Availability

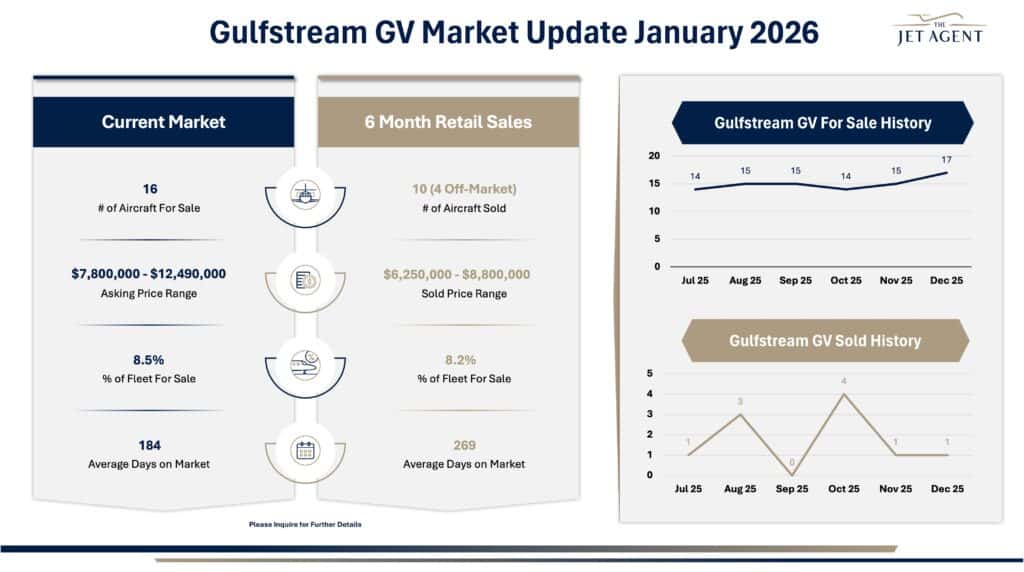

There are currently 16 Gulfstream GV aircraft offered for sale worldwide, representing approximately 8.5% of the active fleet. Inventory remains elevated relative to newer-generation Gulfstream models but has been broadly stable in recent months, suggesting a steady flow of sellers rather than a surge of distressed listings. The GV occupies a transitional position in the market, appealing to buyers seeking long-range capability at a lower acquisition cost while balancing age-related ownership considerations.

Market Listings

Asking prices currently range from $7,800,000 to $12,490,000. Pricing dispersion is driven primarily by maintenance status, engine program enrollment, avionics upgrades, and interior condition, with upcoming inspections playing a central role in buyer decision-making. Active listings are averaging 184 Days on Market, reflecting a buyer pool that remains engaged but highly selective. Aircraft priced toward the upper end of the range require strong justification through recent maintenance events and comprehensive upgrades, while price misalignment continues to extend marketing timelines.

Sales Activity

Over the past six months, 10 Gulfstream GV aircraft have sold, including four off-market transactions. Sale prices ranged from $6,250,000 to $8,800,000, with sold aircraft averaging 269 Days on Market. The longer transaction timelines relative to active listings underscore the importance of realistic pricing and patient execution. Off-market sales remain a meaningful component of activity, indicating that discreet marketing and targeted buyer outreach can be effective tools for sellers navigating this segment.

Key Takeaways

• Inventory levels provide buyers with leverage, particularly on maintenance-heavy aircraft.

• Pricing outcomes are closely tied to inspection timing and total cost of ownership.

• Off-market transactions continue to support liquidity in a mature fleet segment.

Key Insight

The Gulfstream GV market remains healthy but value-driven, with successful transactions hinging on disciplined pricing and transparent disclosure of maintenance exposure. Sellers who align expectations with current buyer economics can still achieve timely execution, while aspirational pricing continues to materially lengthen market cycles.