The Citation Market Just Blinked — Here’s What It Means for 2026

By Denise Wilson, President & Founder, The Jet Agent

2025 has brought meaningful shifts to the preowned jet markets, especially within Citation markets. As a brokerage specializing in Citations, we monitor the dynamics of each aircraft model’s market closely. Several clear trends have emerged this year that should be on your radar if you are watching your aircraft’s value or considering your next move within the next 12-18 months. This article looks across the Citation Mustang and CJ series through the M2 and on to the CJ4 Gen2 to outline where the market stands today and what we can expect moving into 2026.

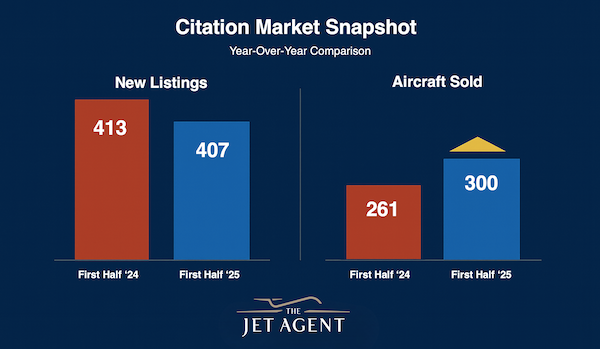

General Business Jet Flight and Sales Activity

As 2025 draws to a close, private aviation flight activity looks meaningfully stronger than it did a year ago. WINGX reports that U.S. business jet departures in Week 47 of 2025 were 8% higher than the same week in 2024 and rolling four-week activity during November ran nearly 8% above last year’s levels. This represents the strongest sustained uptick in flight activity since the post-pandemic surge. While this rise is not (yet) a full-year statistic, the most recent data clearly shows that U.S. business-jet flying is growing again, and faster than earlier 2025 trends suggested. This resurgence matters because higher utilization historically correlates with firmer demand across the light jet market.

At the same time, roughly 7.4% of the active business-jet fleet listed for sale; modestly higher than pandemic-era lows but still well below the long-term pre-COVID norm of 8-10%. Despite this modest rebound, availability remains constrained, especially for late-model, low-time jets. At the same time, pre-owned transaction volumes are above long-term averages, underscoring persistent demand for quality aircraft. The result is a market entering 2026 with balanced conditions overall but selective tightness for the most desirable aircraft.

Inventory: Balanced Overall, Tight for the Best Airframes

Inventory conditions across the single-pilot Citation lineage (Citation Mustang and CJ series through the M2 and on to the CJ4 Gen2) can best be described as being a “balanced” market. Across single-pilot Citation markets, available inventory is currently (as of December 1, 2025) 6.84% of the active fleet. This is materially higher than the 1–2% availability seen during the 2021–2022 crunch, but significantly lower than pre-pandemic norms.

Yet the composition of that inventory tells a different story.

Across all Citation segments, the same pattern emerges – turnkey, low-time, clean-pedigree aircraft are relatively scarce while older airframes and aircraft with damage history and/or stories comprise a disproportionately large share of listings.

This dynamic is especially clear when we start looking more closely at individual markets. In the CJ3+ market, where only about 5% of the fleet is listed for sale, early serial number and other high-demand options often sell before ever reaching the open market. By contrast, the CJ2 market currently has about 10% of its fleet available. A significant share of that inventory involves aircraft with a history of corrosion, hail or other damage, incomplete records, or other “stories” that limit real buyer interest. New Garmin avionic panel options will likely bifurcate the CJ2 market and increase demand over time.

Two subsets of aircraft now exist – aircraft that sell within days or weeks, and aircraft that linger for months. Late-model, low-time aircraft with modern avionics such as Garmin G3000 and excellent pedigree continue to sell within days or weeks. In contrast, older aircraft with higher airframe/engine time, damage history, avionics nearing obsolescence, dated cosmetics, or limited program coverage can sit on the market for months or even years. This subset split distorts Days-on-Market statistics, making the overall average look softer than true demand for desirable aircraft would suggest.

Pricing across the single-pilot Citation family has largely stabilized, with meaningful firmness returning to the top of the market. Newer models, particularly the M2 Gen2, CJ3+, and CJ4 Gen2, have maintained steady pricing throughout 2025, with clean, well-pedigreed examples often transacting near ask and, in rare cases, commanding off-market premiums. In contrast, older aircraft markets such as the Mustang, CJ/CJ1/CJ1+, and CJ2/CJ2+ show the widest pricing spread, reflecting significant variation in avionics, maintenance status, pedigree, cosmetic condition, total time and engine program status. For buyers, this creates a wide value spread: some aircraft represent excellent opportunities, while others require substantial investment to modernize or improve.

Overall, residual values are stabilizing. While the sharp appreciation of 2021–2022 has passed, the softness seen in late 2024 has not continued, positioning 2025–2026 as a period defined by balance rather than volatility.

Key Forces Shaping 2026

Several forces are shaping what 2026 will look like for Citation owner-operators, and together they point to a market that will remain highly competitive for the most desirable single-pilot jets. The return of 100% bonus depreciation in 2025, without phase-outs, continues to be one of the strongest economic tailwinds, accelerating year-end purchases and pulling many buyers forward into early 2026, particularly those targeting late-model aircraft. Financing availability is also robust, with banks showing strong appetite for well-qualified aviation borrowers and offering competitive terms that are unlikely to constrain buyers in the coming year. A new generation of young, aviation-savvy buyers is entering private aviation primarily for business efficiency rather than luxury, expanding demand across the entire single-pilot Citation lineage. Many of these newer entrants are intentionally “buying ahead,” selecting aircraft that exceed their immediate mission needs to avoid short-interval upgrades. Finally, OEM backlogs remain long, with new-aircraft delivery slots stretching into 2027. As a result, more buyers are expected to shift into the pre-owned market in 2026, increasing competition for high-quality, low-time aircraft across the entire Citation family of aircraft.

What This Means for CJP Members

For CJP members, the evolving market has several practical implications.

Members considering selling may benefit from a seller-friendly environment, provided their aircraft is turnkey, low-time, recent on inspections, well-documented, and equipped with modern avionics. Late-model aircraft in excellent condition remain in high demand, particularly the M2 Gen2, CJ3+, and CJ4 Gen2, despite the looming future deliveries of Gen3 variants.

Members exploring an upgrade should begin early rather than later. The most desirable aircraft frequently transact off-market and require proactive outreach and relationships to secure. Additionally, year-end price jumps driven by buyers seeking bonus-depreciation advantages typically make the first half of the year a better time to find value.

Members planning to hold long-term can expect a relatively predictable ownership experience, especially those that own aircraft with Williams engines. Rising flight activity, lower-than-average inventory, steady demand for light jets, and well-distributed pricing all point to a stable environment and sustained residual-value retention in 2026.

For members reassessing their mission profile, early 2026 is an ideal time to evaluate whether an upgrade aligns with their evolving needs.

Conclusion: Stability today, Opportunity Ahead

The single-pilot Citation lineage enters 2026 with unusually strong footing: flight activity is rising, inventory is balanced but selective, and pricing remains stable, especially for the most desirable aircraft. For CJP members, this creates a rare moment of clarity in an often-cyclical market. Those holding their aircraft can expect predictable value retention. Sellers with clean, well-maintained aircraft stand to benefit from persistent demand. Those planning an upgrade will benefit from early preparation and a well-coordinated search, especially in a market where the best aircraft rarely reach the open listings.

As 2026 approaches, Citation owner-operators are entering a market shaped by a smooth ride rather than by turbulence. Flight activity is rising, pricing is steady, and inventory is balanced overall. Whether you are considering a sale, exploring an upgrade, or reassessing how your aircraft fits your mission, the year ahead offers meaningful opportunity for those who approach the market with patience and a solid strategic plan.

Denise Wilson of The Jet Agent has over 25 years of experience in all facets of the aviation industry, including over 20 years of flying Citations and 19 years of experience assisting clients in the acquisition and sales of jet aircraft. She authored the Amazon #1 Bestseller “The Insider’s Guide to Buying and Selling Jets” and has been a CJP member since 2012.